Tax Incentives

Located in a business-friendly state like North Dakota offers numerous incentives and tax advantages to the Devils Lake economy. North Dakota’s top corporate income tax rate is 4.31% and the Tax Foundation ranks North Dakota in the Top Ten states for overall corporate taxes. North Dakota is also quite favorable for personal income taxes. It has a progressive income tax that is one of the lowest in the country, with a top marginal rate lower than any state with an income tax. The combined state and local general sales tax collection per capita is $1,201 per capita, ranking eighth-best in the nation. Go to the Office of State Tax Commissioner website for further information on North Dakota’s individual and business taxes.

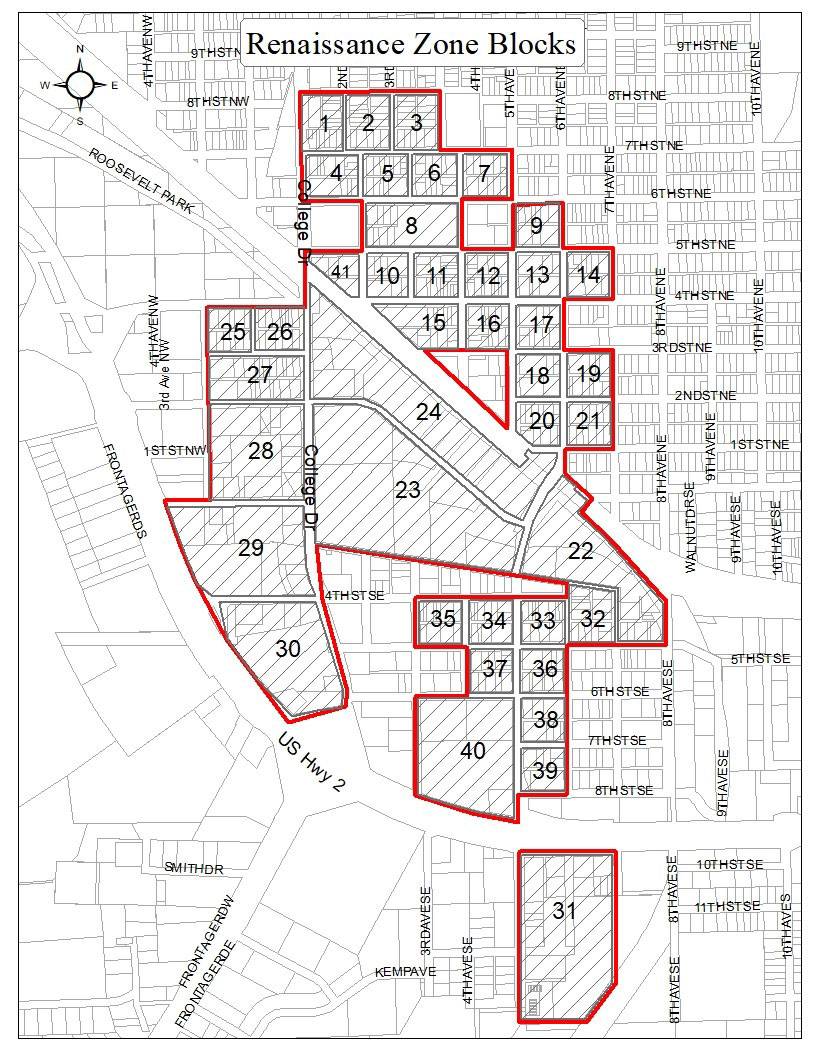

Renaissance Zone

In 1999, the North Dakota Legislative Assembly approved the Renaissance Zone Act to provide tax incentives to encourage investment in downtown or other blighted properties. Existing and new owners of commercial and residential properties within an established 40 block area in the City of Devils Lake (see map below) may be eligible to receive property and state income tax incentives with a qualifying investment in a building purchase, new construction or rehabilitation. Businesses leasing space in buildings improved as Renaissance Zone projects may also be eligible for state income tax incentives.

Tax Incentives:

Business/Commercial Properties

- Up to 100% exemption from property taxes for 5 years

- 100% exemption from state tax on income derived from business or investment for 5 years up to $500,000 of taxable income

- Transferable exemptions with sale or lease

Primary Residences

- Up to 100% exemption from property taxes for 5 years

- 100% exemption from state individual income tax up to $10,000 annually for 5 years

- Transferable exemptions with sale

Applications must be approved before improvements begin. A Renaissance Zone project must be approved by the Devils Lake Renaissance Zone Committee, the Devils Lake City Commission, and the ND Dept of Commerce before an eligible purchase, rehabilitation, new construction project or lease of the property begins. A certificate of good standing from the ND Tax Department is also required along with a business incentive agreement. Please allow one to two months for the review process.